Landlord Blog

Education and news for smart DIY landlords!

Escalation Clause: What Is It? Why And When Should You Use It?

Tired of seeing your dream property bought by someone else? Or are you fed up with being outbid in your local real estate market every time you see a potential home for an investment? If so, you should consider using escalation clauses. Know more about it, why you should consider using a few, and the best time to use them.

What Is An Escalation Clause?

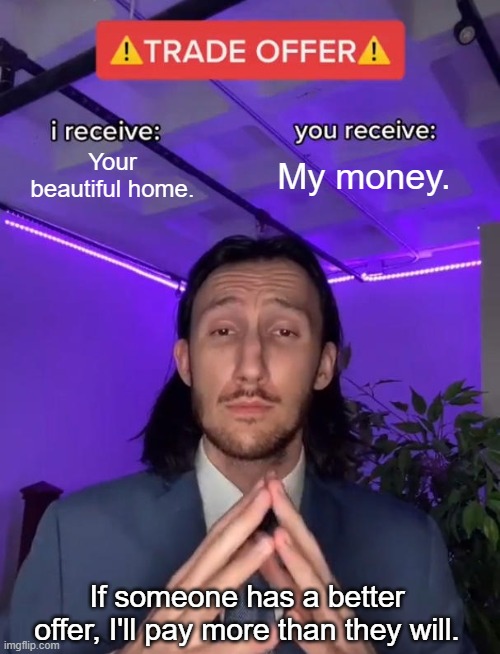

An escalation clause is a type of real estate contract in which a homebuyer would increase their offer if a seller receives an offer higher than the buyer’s initial offer. For example, if you’ve presented a house seller with an offer of $350k for their home and another buyer offers $370k, you can use an escalation clause of “I’m willing to increase my offer to $400k.”

Why Should You Use An Escalation Clause?

To keep your offer relevant during negotiations

By the time a good property gets listed on the market, multiple offers start to pour in and the not-so-desirable deals are quickly shut out. Using an escalation clause during these periods will help you have a seat at the negotiation table. And this will be the same for other properties in hot local real estate markets or a seller’s market.

To make sellers take you more seriously

Sellers who receive an offer from a buyer that includes escalation clauses will tend to put that buyer their first priority. They’ll think that “Okay. This person is willing to pay more than what my property is appraised for or my listing price and they’re highly motivated to shut out other buyers. I should send them the offer of others first so that I can really stretch my profit margin.”

When Should You Use An Escalation Clause?

If the subjected property is your dream home or has huge potential for increasing its market value

There are plenty of properties that check all the boxes of what buyers really want. To make things better, these properties are also in areas where the prices of homes are rising. And we don’t want to let that property become TOTGA. Using an escalation clause will make sure that you would get that dream home no matter what the cost.

If you’re expecting the subjected property will receive multiple offers

The thing about a dream home is that it is also likely to be the dream home of others. And as a smart home buyer, you can expect that such a property will be highly contested. Using an escalation clause in this situation puts you at an advantage during the negotiation process because as mentioned, it makes you the first priority in the eyes of a home seller.

If you want the home so bad but don’t want to overpay

Now, there are some of us who really want to buy a property but don’t have the money to or want to overpay. But the concept of escalation clauses is to make you go all-in just to win the bidding war.

However, there are ways to do it right. You can either say, “I’ll pay as much as $380k if you receive an offer higher than my initial offer and there are no others with a higher deal” or “I’ll pay an additional $1k more than the latest other bidder with the highest offer.” It all comes down to how far you’re willing to go and how you use the clause’s verbiage.

Overall, escalation clauses are double-edged swords because they can help you get the property you want. But from an investment perspective, it can waste your savings if the home’s future selling value doesn’t yield significant profit.

To use escalation clauses properly, you need to include contingencies so you can lessen your doubts about paying more. You must study the future real estate market of where the subjected property is located by seeking the advice of a real estate professional.

You should keep in mind that every home buying situation is unique. Some sellers might not accept an escalation clause and others would want you to present your best offer from the start. This will help you draft a deal that doesn’t immediately give away your maximum budget.

And lastly, use escalation clauses when necessary. Don’t use them if the data of the property you’re eyeing shows little buying competition.